International debt, asset price bubbles, complex securities and other matters of instability of the financial system put social and economic development at risk, as the current financial crisis is showing. Moreover, debt of the global South constrains its options for poverty eradication, public health, education,

Affected people and foundations of life: Debt problems and other poorly secured financial transactions induced the Asia crisis, the Argentina crisis, the dying of dot-coms, the subprime crisis and its global consequences, etc. The financial system entails a higher risk than other parts of the economy, because the consequences of market failure are not restricted to the market in question; instead, the collapse of just one financial institution might trigger the implosion of the entire financial system (systemic risk) and would also drag down the real economy ( 2008, 4). The financial system has a tendency to be procyclical, overexpanding in good times and retrenching sharply in bad times, exacerbating the likelihood of financial instability and amplifying undesirable macroeconomic feedbacks ( 2008, 44). In 2005 the Counterparty Risk Management Policy Group (CRMPG) in its "Corrigan report", that was prepared by senior officials from a number of private financial institutions, came to the conclusion, that since the Asia crisis the statistical probabilities of the occurrence of major systemic financial shocks have decreased. But the damage caused by such a shock would be greater because of the enormous rise in speed and complexity and the tightening of linkages in the global financial system. In addition to that CRMPG concluded, that the financial world's capacity to anticipate systemic shocks is nil. (CRMPG 2005.) Now the risk event has occured.

Over the period 1970 to 2007, there emerged 124 banking crises, 208 currency crises, and 63 sovereign debt crises at national level (including 42 twin crises and 10 triple crises; Laeven/Valencia [] 2008, 7 and 56). Fiscal costs of financial crises in emerging markets in the 1980s and 1990s topped 1 trillion ( 2006). There were common denominators across all post-1980 financial crises: credit concentrations (in specific borrowers), broad-based maturity mismatches, excessive leverage, the illusion of market liquidity – or the belief that such liquidity will always be present –, and macroeconomic imbalances, including such forces as inflation, recession, budget deficits, and large external account imbalances (CRMPG 2008, 6).

In late 2006 to July 2007 the US housing market bubble bursted, and foreclosures rose. This turmoil has turned into a global financial crisis. Credit flows froze, and lender confidence dropped. One after another the economies of countries around the world dipped into a downturn or recession. In particular in September 2008, some of the largest and most venerable banks, investment houses, and insurance companies have either declared bankruptcy or have had to be rescued financially. ( 2008, 2.) For a short time a collapse of the global financial system was impending, which would have had imponderable real economic consequences. However, central banks and governments were able to avert such developments by their determined intervention. (SRW 2008, .) The crisis exposed fundamental weaknesses in financial systems worldwide, and despite coordinated easing of monetary policy and trillions of dollars in intervention, the financial and economic crisis continues (CRS 2008, 2). The causes and contributing circumstances of the financial crisis were analysed by organizations like the IMF, the , the Group of Twenty industrial and emerging market countries (G-20), central banks and their Financial Stability Forum (FSF), the research service for the US Congress (CRS), the private-sector-based Institute of International Finance (IIF) and the above-mentioned CRMPG, scientific boards, etc.:

- The decline in lending and due diligence standards in the US mortgage and related securities markets undermined market confidence (IIF 2008, 15).

- Certain countries incurred large deficits in international trade and current accounts (particularly the United States), while other countries accumulated large reserves of foreign exchange by running surpluses in those accounts (CRS 2008, 12). These macroeconomic imbalances have long been recognized as potential sources of instability (CRMPG 2008, 3, 6; UN 2005, 165; 2008, 17f.).

- Investors deployed 'hot money' in world markets seeking higher rates of return. These were joined by a huge run up in the price of commodities, rising interest rates to combat the threat of inflation, and a cyclical slowdown in world economic growth rates (CRS 2008, 12). The implications of building asset price bubbles were not recognized even in the advanced stages of their development (CRMPG 2008, 133; with the exception of warnings like UN 2006, 23-24).

- Banks, market participants and the authorities have all underestimated the risks to which many banks and other financial institutions have been exposed (BoE 2008, 42). There has been a general underpricing of credit risk (G-20 2008, 3). Failures in risk management policies, procedures, and techniques were evident at a number of firms (IIF 2008, 9). Other firms had exercised better practices ( 2008). However, risks that had been expected to be broadly dispersed turned out to have been concentrated in entities unable to bear them (FSF 2008, 9).

- Banks, investment houses, and consumers carried large amounts of leveraged debt (a high proportion of debt or assets to equity; CRS 12). High leverage has been a significant factor amplifying losses and leading to some financial institutions needing to sell securities into falling markets (G-20 SG 2008, 22). The current turmoil has made clear to what kind of result a high leverage can lead: Losses being low compared with bank assets can exhaust a large portion of equity capital ( 2008, 6).

- Banks and other financial institutions gave substantial impetus to a high leverage by establishing off-balance sheet funding and investment vehicles. In many cases those invested in highly rated structured credit products, in turn often largely backed by mortgage-backed securities (MBS). These vehicles, which benefited from regulatory and accounting incentives, operated without capital buffers, with significant liquidity and maturity mismatches and with asset compositions that were often misunderstood by investors in them. Both the banks themselves and those that rated the vehicles misjudged the liquidity and concentration risks that a deterioration in general economic conditions would pose. Banks also misjudged the risks that were created by their explicit and implicit commitments to these vehicles. (FSF 2008, 5.)

- The originate-to-distribute model of these vehicles increased risk in financial markets: The originator of credits or mortgages passed them on to the provider of funds or to a bundler who then securitized them and sold the collateralized debt obligation (CDO) to investors (CRS 2008, 11). Risks were being transferred to the unregulated segment of the market (Laeven/Valencia [IMF] 2008, 26). There also was a lack of transparency about the risks underlying securitised products, in particular including the quality and potential correlations of the underlying assets (FSF 2008, 9f.).

- In order to cover the risk of defaults on credits or mortgages, particularly subprime mortgages, the holders of CDOs purchased credit default swaps (CRS 2008, 8). This implied a blurring of lines between issuers of credit default swaps (CDS) and traditional insurers. In essence, financial entities were writing a type of insurance contract without regard for insurance regulations and requirements for capital adequacy. (CRS 2008, 11.)

- Credit rating agencies have not conveyed the full array of risks embedded in structured products (IIF 2008, 15). Risk assessments by rating agencies tend to be highly pro-cyclical as they react to the materialization of risks rather than to their build-up (UN 2008b, 29). Moreover, risk was also increased by a rise of perverse incentives and complexity for credit rating agencies. Credit rating firms received fees to rate securities based on information provided by the issuing firm using their models for determining risk. (CRS 2008, 11.) Some institutional investors have relied too heavily on ratings in their investment guidelines and choices, in some cases fully substituting ratings for independent risk assessment and due diligence (FSF 2008, 37; IIF 2008, 16).

- Compensation schemes in financial institutions encouraged disproportionate risk-taking with insufficient regard to longer-term risks. This risk-taking was not always subject to adequate checks and balances in firms' risk management systems. (FSF 2008, 8.)

- Public disclosures that were required of financial institutions did not always make clear the type and magnitude of risks associated with their on- and off-balance sheet exposures (FSF 2008, 8).

Policy-makers, regulators and supervisors, in some advanced countries, did not adequately appreciate and address the risks building up in financial markets, keep pace with financial innovation, or take into account the systemic ramifications of domestic regulatory actions

(G-20 2008, § 3). Public authorities recognised some of the underlying vulnerabilities in the financial sector but failed to take effective countervailing action, partly because they may have overestimated the strength and resilience of the financial system (FSF 2008, 9). Despite increasing globalization, supervision of financial markets still is managed mostly in a national scope. As a result the regulators suffered from a kind of tunnel vision, which obviously prevented them from recognizing grave aberrations timely. (SRW 2008, § 264.)- Limitations in regulatory arrangements, such as those related to the pre-Basel framework, contributed to the growth of unregulated exposures, excessive risk-taking and weak liquidity risk management (FSF 2008, 9). The fundamental pro-cyclicality of the financial system has even been raised in the last years through regulation, by valuation of assets according to market prices (fair value), by risk-weighting of assets introduced by Basel II, and models of risk assessment used for that purpose (SRW 2008, § 266).

Total mark-to-market losses on securitized credit instruments and corporate bonds across the , the Euro area and the have risen to around US$ 2.8 trillion (losses until 20 Oct 2008 compared to Jan 2007; a further increase is expected; BoE 2008, 12 and 14). This is equivalent to 5.1% of the global (IMF 2008b, 259, and by own calculation).

Governments of twenty industrialized countries supported their banking systems by guarantees of US$ 5 269 billion (including some guarantees of bank's wholesale debt or nationalizations of banks), capital injections of US$ 711 billion, purchases of assets of US$ 659 billion, and other supports of US$ 1 413 billion (announcements until 24 Oct 2008; BoE 2008, 33; CRS 2008, 15; dollar values in column 3 and 4 corrected according to column 1 and 2 by own calculation). Most of these support packages consist of credits yielding interest, shares in banks, guarantees against fee, or swaps of securities (so there are options for a return of money).

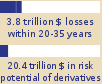

As an indicator to supply information about the potential scale of market risk in derivatives transactions,

the outstanding gross market values in the global "over the counter" derivatives market are in use. They have doubled between December 2006 and June 2008 from US$ 9.69 to 20.4 trillion – which is equivalent to a third of global GDP. Among these derivatives, the gross market values of the above-mentioned outstanding credit default swaps (CDS) jumped from US$ 470 billion in December 2006 to US$ 2.00 trillion in December 2007 and US$ 3.17 trillion in June 2008. ( 2008, 5 and 6.)

The financial crisis and its aftermath has been remarkably indiscriminate. It has struck nearly all countries regardless of political system or size and even those not exceptionally exposed to risky debt. (CRS 2008, 1.) There are four main spillovers that have been evident across financial markets of most emerging economies: a rise in the price of risk, along with a rise in global risk aversion; a sell-off in equity markets; pressure on currencies; and a reduction in external financing (G-20 SG 2008, 23). The world hunger situation may further deteriorate as the financial crisis hits the real economies of more and more countries. Reduced demand in developed countries threatens incomes in developing countries via exports. Remittances (money sent home from migrant workers), investments and other capital flows including development aid are also at risk. ( 2008a.)

Countries of the global South have a total debt burden of US$ 2.7 trillion to industrialized countries (WB 2007, 187), which, on the other hand, themselves have public and private foreign debts of more than US$ 30 trillion ( 2006). While the less developed debtor countries – at least the poorest of them – have practically no prospects of paying off their debts, their debt service constrains their options to develop economically and to undertake social tasks. The debt service paid in 2005 by less developed countries to industrialized countries amounted to US$ 513 million (WB 2007, 187). They paid 6.6% of their exports and net income from abroad in 2006. Lain America paid 14.8%. (UN 2008a, indicator 8.12.) The debt service of the South is five times the received development assistance and nearly double the direct investments. During the acute debt crisis in the eighties the debt service ratio was much higher, but it still is a chronic burden to the economies of the South. ( 2007, 293.)

Targets/goals:

- Financial crises:

to ensure that a global crisis, such as this one, does not happen again

(G-20 summit declaration: G-20 2008, § 2). - Debt of poor countries: a debt relief for heavily indebted poor countries, and a cancellation of all bilateral debts (goal of Millennium Summit: UN 2000, § 15.2).

Trends:

- Financial crises: − Since 1970 the number of systemic banking crises has increased (Caprio/Klingebiel [WB] 2003; Laeven/Valencia [IMF] 2008, 56), and in 2007/08 the worst financial crisis since 1929 has emerged.

- Debt of poor countries: + In 2007 there was a cumulative debt relief of US$ 69 billion (regarding the Highly Indebted Poor Country Initiative and the Multilateral Debt Relief Initiative; UN 2008b, indicator 8.11).

Measures:

Financial crises: Improved risk management by private actors and a far-sighted regulation of financial markets could reduce risks for economic and social development. Incentives should be aligned to avoid excessive risk-taking (G-20 2008, § 9). To prevent another global financial crisis, all actors involved are required to 'think the unthinkable' (G-20 SG 2008, 35). The Group of Seven industrialized countries (G-7) committed to full and rapid implementation of the recommendations made by the Financial Stability Forum (G-7 2008; FSF 2008). For the first time being, the leaders of the Group of Twenty major economies (G-20) held a summit in November 2008 and agreed on several principles as well as an action plan (G-20 2008). Likewise, the private sector has agreed on principles of conduct and best practice recommendations. The industry as a whole recognizes its responsibility and is fully determined to address these weaknesses.

(IIF 2008, 23.) There are eight areas:

- Temporary measures

- Support systemically important financial institutions and prevent their failure (G-7 2008)

- Easing monetary conditions on firms' financing costs and providing liquidity (while avoiding both deflation and high inflation)

- Restrictions or bans on uncovered ("naked") short sellings

- Extensions of depositor insurance and/or guarantees for wholesale funding

- Provisions to take equity stakes in financial institutions and/or to buy impaired debt from them ( to swap securities)

- Increases in public spending to stimulate the economies

- Ensuring that international financial institutions (IMF, WB, etc.) can provide critical support. (G-20 SG 2008, 40; G-20 2008, §§ 5 and 7; IMF 2008, 50.)

- Strengthening transparency, accountability and valuation

- Ensuring complete, accurate, and timely disclosure by firms of their financial conditions (including off-balance sheet activities) on an ongoing basis

- Enhancing required disclosure on complex financial products

- Enhancing guidance for valuation of securities, especially of complex, illiquid products, and during times of stress

- The key global accounting standards bodies (, , etc.) should work intensively toward the objective of creating a single high-quality global standard. (G-20 2008, § 9, and action plan, 1.)

- Enhancing sound regulation: capital, liquidity, risk management, and credit ratings

- Ensuring that all financial markets, products and participants are regulated or subject to oversight (G-20 2008, § 9; this includes complex securities, credit rating agencies, private equity funds, hedge funds, etc.)

- Developing recommendations to mitigate pro-cyclicality, including the review of how valuation and leverage, bank capital, executive compensation, and provisioning practices may exacerbate cyclical trends. (G-20 2008, action plan p. 2.) The basic objective of prudential regulation and supervision should be to introduce strong counter-cyclical rules (UN 2008b, 30).

- Strengthening capital requirements: Authorities should ensure that financial institutions maintain adequate capital in amounts necessary to sustain confidence. International standard setters should set out strengthened capital requirements for banks' structured credit and securitization activities. (G-20 2008, action plan p. 2.) Supervisors must set capital and liquidity buffers at levels that take account of the potential for risk management failures to occur and that limit damage to markets and the financial system when they occur (FSF 2008, 10; 2002, 115f.). This includes further improvements to the Basel II capital framework (FSF 2008, 12; BoE 2008, 42).

An important complement to Basel II would consist of fixing a leverage ratio between equity and liabilities, like it already applies to US banks (leverage ratio; SRW 2008, § 275; SNB 2008, 8). The risk-weighing of current capital requirements serves for considering the different risks of a banks' assets. In addition, a leverage ratio would guarantee a minimal security buffer, which is in proportion to the banks' volume and not dependent on complex and hardly verifiable risk-weights. (SNB 2008, 9.)

To mitigate pro-cyclicality, it is considered to allow capital requirements to be flexible or varying, corresponding to indicators such as balance sheet total, growth, and inflation (SRW 2008, §§ 290-292; BoE 2008, 42). - Strengthening liquidity standards: Supervisors and central banks should develop robust and internationally consistent approaches for liquidity supervision of cross-border banks (G-20 2008, action plan p. 3). Most of the current defences in the supervisory framework are presumably designed to handle idiosyncratic risks to liquidity, rather than the more challenging case of a systemic problem, where everyone is scrambling for liquidity (G-20 SG 2008, 35). Liquidity standards should be strengthened to ensure that firms are sufficiently resilient to a range of shocks (BoE 2008, 41, table 6.A, and 43; FSF 2008, 12).

- Enhancing risk management: Supervisors should ensure that financial firms develop processes that provide for timely and comprehensive measurement of risk concentrations and large counterparty risk positions across products and geographies (G-20 2008, action plan p. 3). Supervisors will strengthen banks' risk management practices, to sharpen banks' control of tail risks (events in the adverse tail of risk distributions) and mitigate the build-up of excessive exposures and risk concentrations, including off-balance sheet activities (FSF 2008, 17 and 19). Banks even have to consider those kind of shocks, which occur rarely, but show a high potential of damage (tail events; SNB 2008, 10).

Action needs to be taken, through voluntary effort or regulatory action, to avoid compensation schemes which reward excessive short-term returns or risk taking (G-20 2008, action plan p. 3). The financial industry should align compensation models with long-term, firm-wide profitability (FSF 2008, 20; SRW 2008, § 262). This should also be the focus of promotions and awarding job titles in senior and executive management. Additionally, compensation practices should be heavily stock-based with such stock-based compensation vesting over an extended period of time (CRMPG 2008, 5).

Better incentives within the process of securitization can be achieved foremost by obliging the originator – that means the bank, which provides the securitization – to keep a certain part of particular risky tranches of assets in their own portfolio. Such a deductible shall contribute to a more careful selection of borrowers and a better monitoring after granting a credit. (SRW 2008, § 262.)

Supervisors and regulators should speed efforts to reduce the systemic risks of CDS and over-the-counter (OTC) derivatives transactions (G-20 2008, action plan p. 3). Market participants should ensure that the settlement, legal and operational infrastructure underlying OTC derivatives markets is sound (FSF 2008, 20). The financial industry should create a clearinghouse for outstanding OTC derivatives, starting with CDS (CRMPG 2008, 1).

Risky volumes of derivatives could be limited by a tax on foreign exchange transactions (Tobin tax; EK 2002, 115f.).

Central banks are challenged to consider in their monetary policy not only the stability of money value, but more than up to now the stability of the financial system (SRW 2008, § 261). - Supervision of credit rating agencies: G-20 members will exercise strong oversight over credit rating agencies. Rating agencies that provide public ratings should be registered. (G-20 2008, § 9, and action plan p. 3). An external review of the rating process should be established (IIF 2008, 16). Credit ratings agencies should review the quality of the data input and the due diligence performed by originators, arrangers and issuers. They should expand information on structured products. (FSF 2008, 58.) Rating agencies should develop a different or additional scale (and/or system of symbols) for rating structured products – which in stressed market conditions can have much higher rating and price volatility than, for example, corporate bonds (IIF 2008, 16; FSF 2008, 58).

- Promoting Integrity in Financial Markets

- National and regional authorities should implement national and international measures that protect the global financial system from uncooperative and non-transparent jurisdictions that pose risks of illicit financial activity (G-20 2008, action plan p. 4, and § 9). This may include a special jurisdiction regarding offshore finance centres, and regulations on transactions with them (EK 2002, 115f.).

- Reinforcing international cooperation and the authorities' responsiveness to risks and stress

- Regulators should take all steps necessary to strengthen cross-border crisis management arrangements, including on cooperation and communication with each other and with appropriate authorities (G-20 2008, action plan p. 4, and § 9).

- Supervisors should see that they have the requisite resources and expertise to oversee the risks associated with financial innovation and to ensure that firms they supervise have the capacity to understand and manage the risks. Authorities will review and, where necessary, strengthen deposit insurance arrangements, as well as arrangements for dealing with weak banks. International bodies will enhance the speed, prioritisation and coordination of their policy development work. (FSF 2008, 40, 50, 49 and 60.)

- A global early warning system should be established, with the IMF and FSF working closely together to analyse the risks to global financial stability, and the links between macroeconomic events and prudential regulation ( 2008, 15). An international system for recognizing risks and early warning should have access not only to macroeconomic information but also to microprudential data on individual large financial institutions (SRW 2008, § 6, and p. 6). The finance industry establishes a Market Monitoring Group to provide ongoing assessment of global financial market developments for future vulnerabilities (IIF 2008, 23).

- Further mechanisms of international cooperation are considered:

evaluating periodically the quality of national regulatory and prudential supervisory systems in different countries, thus introducing a international supervision of national supervisors;

fixing and controlling, at an international level, central regulatory quantities and minimum norms – like they already exist, for instance, in the area of risk-adjusted capital requirements within the framework of Basel II;

international monitoring and microprudential supervision of such financial institutions, which have cross-border activities and are of systemic relevance;

a global crisis team could get active during systemic financial crises and coordinate an effective political reaction. (SRW 2008, §§ 6, 269, 272, and 274-277.)

- Reforming International Financial Institutions

- The Bretton Woods Institutions (IMF and World Bank) should more adequately reflect changing economic weights in the world economy. Emerging and developing economies, including the poorest countries, should have greater voice and representation. The FSF must expand urgently to a broader membership of emerging economies. (G-20 2008, § 9; EK 2002, 115f.)

- Context of reforms

- G-20 members agreed to reject protectionism and to refrain, within the next 12 months, from raising new barriers to investment or to trade in goods and services.

- With regard to the impact of the current crisis on developing countries, particularly the most vulnerable, G-20 members reaffirm the importance of the Millennium Development Goals and the development assistance commitments they made.

- G-20 members remain committed to addressing other critical challenges such as energy security, climate change, and food security. (G-20 2008, §§ 13-15.)

- Global account imbalances

- To mitigate the risk of a disorderly adjustment in the global imbalances, the major economies should coordinate their macroeconomic policies over the medium run (UN 2006, ). IMF analysis suggests that the financial turmoil has made joint action to curb the imbalances more relevant (IMF 2008a). A multilaterally agreed strategy on global imbalances called for: steps to boost national saving in the United States, including fiscal consolidation; further progress on growth-enhancing reforms in Europe; further structural reforms, including fiscal consolidation, in Japan; reforms to boost domestic demand in emerging Asia, together with greater exchange rate flexibility in a number of surplus countries; and increased spending consistent with absorptive capacity and macroeconomic stability in oil-producing countries (IMF 2007). More far-reaching recommendations include import certificates, an International Clearing Union, or a reform of the present international reserve system, away from the almost exclusive reliance on the United States dollar and towards a multilaterally backed multi-currency system which, perhaps, over time could evolve into a single, world currency-backed system (UN 2008b, 33).

All measures should be part of a framework guaranteeing that default risks will be considered in booms ahead – even despite of several years of perceived stability, high yields and high competition, as seen in the period up to mid-2007.

Debt of poor countries: Initiatives for debt relief for poorer countries amounting to US$ 59 and 50 billion were started in 1996 and 2005, which should reduce the annual debt payments by about US$ 1 billion each (Highly Indebted Poor Country Initiative and Multilateral Debt Relief Initiative, UN 2006a, 23).

Annotations: For numeric names the short scale is used:

1 billion = one thousand million = 109 = 1 000 000 000

1 trillion = one thousand billion = 1012 = 1 000 000 000 000

Sources

- BoE 2008 – Bank of England: Financial Stability Report.

October 2008 (Issue No. 24).

October 2008 (Issue No. 24). - BIS 2008 – Bank for International Settlements, Monetary and Economic Department: OTC derivatives market activity in the first half of 2008.

(November 2008.)

(November 2008.) - Caprio/Klingebiel (WB) 2003 – Gerard Caprio and Daniela Klingebiel: Episodes of Systemic and Borderline Financial Crises.

. World Bank, Washington, January 2003.

. World Bank, Washington, January 2003. - CIA 2006 – Central Intelligence Agency: The World Factbook 2005. Debt – external.

- CRMPG 2005 – Counterparty Risk Management Policy Group II: Toward Greater Financial Stability: A Private Sector Perspective.

- CRMPG 2008 – Counterparty Risk Management Policy Group III: Containing Systemic Risk: The Road to Reform; The Report of the CRMPG III.

August 6, 2008.

August 6, 2008. - CRS 2008 – Congressional Research Service: The U. S. Financial Crisis: The Global Dimension with Implications for U. S. Policy.

(CRS Report for Congress, Order Code RL34742) November 18, 2008.

(CRS Report for Congress, Order Code RL34742) November 18, 2008. - ECB 2008 – European Central Bank: Financial Stability Review; December 2008.

- EK 2002 – Enquete-Kommission "Globalisierung der Weltwirtschaft – Herausforderungen und Antworten": Schlussbericht der Enquete-Kommission Globalisierung der Weltwirtschaft – Herausforderungen und Antworten.

Deutscher Bundestag, 14. Wahlperiode: Drucksache 14/9200.

Deutscher Bundestag, 14. Wahlperiode: Drucksache 14/9200. - FAO 2008a – Food and Agriculture Organization of the United Nations: Number of hungry people rises to 963 million; High food prices to blame – economic crisis could compound woes.

9 December 2008, Rome.

9 December 2008, Rome. - FSF 2008 – Financial Stability Forum: Report of the Financial Stability Forum on Enhancing Market and Institutional Resilience.

7 April 2008.

7 April 2008. - G-7 2008 – Group of Seven: G-7 Finance Ministers and Central Bank Governors Plan of Action.

(HP-1195) Washington, October 10, 2008.

(HP-1195) Washington, October 10, 2008. - G-20 2008 – Group of Twenty: Declaration; Summit on Financial Markets and the World Economy. [and] Action Plan to Implement Principles for Reform.

November 15, 2008.

November 15, 2008. - G-20 SG 2008 – G-20 Study Group: Study Group Report on Global Credit Market Disruptions.

31 October 2008.

31 October 2008. - HMT 2008 – Her Majesty's Treasury: Managing the global economy through turbulent times.

London, December 2008.

London, December 2008. - IIF 2008 – Institute of International Finance: Final Report of the IIF Committee on Market Best Practices: Principles of Conduct and Best Practice Recommendations; Financial Services Industry Response to the Market Turmoil of 2007-2008.

July 2008.

July 2008. - IMF 2007 – International Monetary Fund: The Multilateral Consultation on Global Imbalances.

April 2007.

April 2007. - IMF 2008 – International Monetary Fund: Global Financial Stability Report; Financial Stress and Deleveraging; Macrofinancial Implications and Policy; October 2008.

- IMF 2008a – International Monetary Fund: IMF Sees Global Imbalances Narrowing, But More to Be Done.

By Hamid Faruqee, IMF Research Department. February 19, 2008.

By Hamid Faruqee, IMF Research Department. February 19, 2008. - IMF 2008b – International Monetary Fund: World Economic Outlook; Financial Stress, Downturns, and Recoveries.

October 2008.

October 2008. - Laeven/Valencia (IMF) 2008 – Luc Laeven and Fabian Valencia: Systemic Banking Crises: A New Database.

(IMF Working Paper WP/08/224) Authorized for distribution by Stijn Claessens. November 2008.

(IMF Working Paper WP/08/224) Authorized for distribution by Stijn Claessens. November 2008. - SNB 2008 – Schweizerische Nationalbank: Bericht zur Finanzstabilität 2008.

Juli 2008.

Juli 2008. - SRW 2008 – Sachverständigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung: Die Finanzkrise meistern – Wachstumskräfte stärken; Jahresgutachten 2008/09.

November 2008. Print version: ISBN 978-3-8246-0827-0. SFG (Servicecenter Fachverlage GmbH), Kusterdingen. English summary (chapter 1): The German Council of Economic Experts: Mastering the financial crisis – Strengthening forces for growth; Annual Report 2008/09; Summary.

November 2008. Print version: ISBN 978-3-8246-0827-0. SFG (Servicecenter Fachverlage GmbH), Kusterdingen. English summary (chapter 1): The German Council of Economic Experts: Mastering the financial crisis – Strengthening forces for growth; Annual Report 2008/09; Summary.

- SSG 2008 – Senior Supervisors Group: Leading-Practice Disclosures for Selected Exposures.

April 11, 2008.

April 11, 2008. - UN 2000 – United Nations, General Assembly: United Nations Millennium Declaration.

- UN 2005 – United Nations, Department of Economic and Social Affairs: World Economic and Social Survey 2005; Financing for Development.

(E/2005/51/Rev.1, ST/ESA/298) June 2005.

(E/2005/51/Rev.1, ST/ESA/298) June 2005. - UN 2006 – United Nations, Department of Economic and Social Affairs: World Economic Situation and Prospects 2006.

(Sales No. E.06.II.C.2, ISBN 92-1-109150-0) January 2006.

(Sales No. E.06.II.C.2, ISBN 92-1-109150-0) January 2006. - UN 2006a: The Millennium Development Goals Report 2006.

[Published by the United Nations Department of Economic and Social Affairs DESA] New York, June 2006.

[Published by the United Nations Department of Economic and Social Affairs DESA] New York, June 2006. - UN 2008a – United Nations: The Millennium Development Goals Report 2008; [Statistical Annex].

- UN 2008b – United Nations, Department of Economic and Social Affairs: World Economic Situation and Prospects 2009; Global Outlook 2009; Pre-release.

1 December 2008.

1 December 2008. - UNDP 2007 – United Nations Development Programme: Human Development Report 2007/2008; Fighting climate change: Human solidarity in a divided world.

- WB 2006 – World Bank: Financial Crises.

(No date of publication given [probably December 2006], retrieved in 2007.)

(No date of publication given [probably December 2006], retrieved in 2007.) - WB 2007 – World Bank: World Development Indicators 2007; Section 4: Economy.

Draft (2008)

This draft is to be reviewed by experts. Your hints are welcome, please use the contact form.